| Overview

and Goodwill Impairment Tool Inputs

ASC 350 (formerly FAS142) requires

that companies evaluate goodwill valuation on an annual basis or

more frequently if certain triggering events have occured. Evaluating

goodwill involves comparing the fair-value to the recorded value of goodwill.

If recorded value exceeds the associated fair-value, then impairment

has occured and the company must write down a portion or all of their

goodwill.

Our

Tool

helps companies value their goodwill using the discounted cash flow method

and determine the amount of impairment, if any.

Using this method, cash flows are estimated for ten

years and then a 'residual value' is computed for the value of the reporting

unit after ten years. These amounts are then adjusted using a discount

rate to determine their value today.

Tool Inputs

Our Tool allows for up to five different cash flow scenarios.

The user specifies the probability of each outcome. You

may adjust a number of different inputs to model each scenario. The following

inputs are used to gather the information for each goodwill asset (a

new workbook is created for each goodwill asset on the books).

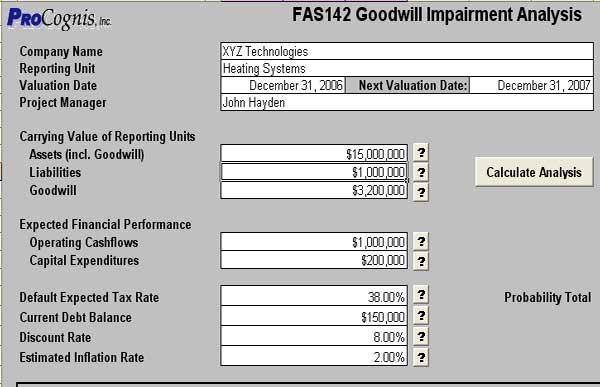

The following inputs are collected for all scenarios

as a basis for computation (see Figure 1):

| Company Name, Reporting Unit and Project Manager |

The Tool provides input for the company name and the associated

reporting unit/subsidiary if needed along with the responsible party. |

| Valuation Date and Next valuation date |

The Tool records the date the current valuation is performed for

use in reporting and a next valuation date is provided to remind

you to perform the next valuation. |

| Carrying Value of Assets (including the goodwill) |

This input gathers the unit's asset balance at the valuation date

that is used in the calculation. |

| Carrying Value of Liabilities |

The Liabilities carried for the Unit, if any. |

| Carrying Value of Goodwill |

The goodwill value recorded for the unit. This value is used to

determine the potential impairment. |

| Expected Operating Cashflows |

The expected cashflows of the unit used as the basis for the growth

rate of cashflows for the scenarios to compute the net present value. |

| Expected Capital Expenditure |

The CapEx spending on the unit used to adjust the cashflows and

as the basis for CapEx growth in the scenarios. |

| Default Tax Rate |

The Tax rate to be used as the default tax rate for all scenarios.

We provide an option to override the individual tax rate for each

year in each scenario to give you more flexibility. |

| Current Debt Balance |

The Debt balance for the unit used to adjust the Net value of the

asset. |

| Discount Rate |

The "Discount" interest rate used to approximate interest and as

the interest rate input to the NPV formula. |

| Estimated Inflation Rate |

The Inflation rate used to adjust the Discount Rate in the Discounted

cash flow method. |

Figure 1. Input screen for all scenarios to provide

basis for computation.

Scenarios

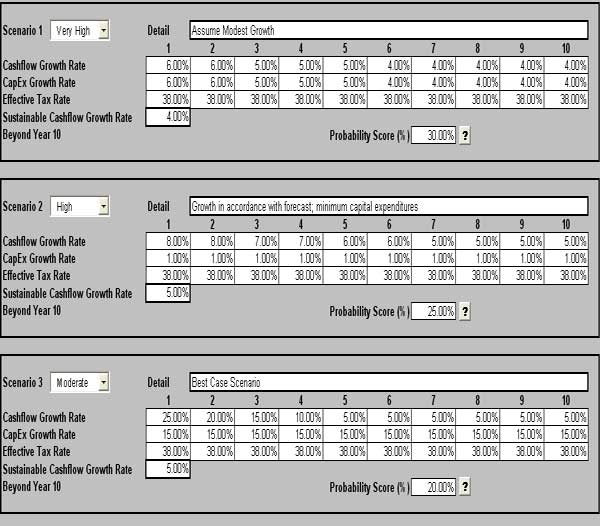

The FAS142 Tool provides spaces for up to five scenarios

each with up to ten years of future performance projections. With these

scenarios, you can project potential future performance for

the unit and to score the various outcomes using a probability input.

The probability input informs the Tool as to how to weight the various

scenarios in the final computation used to determine actual value and

possible impairment. You do not need to use all scenarios (just leave

the probability input as

0

to ignore

unused

scenarios).

Calculations

are

shown for each

scenario. See Figure 2. Help text is available for the key inputs with

the buttons marked with  . .

The following inputs are collected for each scenario:

| Subjective Rating and Detail inputs |

The Detail input gives you a narrative to describe this scenario.

There is also a field to choose between five potential likelihoods:

Very High, High, Moderate, Low

and Remote.

This drop-down

list gives

you

an

easy way

to rate

the scenario (however, this is informational only, the probability

actually determines the rating). |

| Cashflow Growth Rate |

The rate the current Cashflow is expected to change (up or down)

for the unit in this scenario. This input defines the upside potential

for the unit. There are ten inputs for each year in the scenario. |

| CapEx Growth Rate |

The rate the current Capital Expenditure is expected to change

(up or down) for the unit in this scenario. This input defines the

cost

potential

for the unit. There are ten inputs for each year in the scenario. |

| Effective Tax Rate |

The Tax rate used to adjust the value of the Cashflow. This input

defaults to the Default Tax rate defined above but can be overriden

to permit more control (for example to adjust for tax benefits relating

to capital expediture or other possible tax treatment). There are

ten inputs for each year in the scenario. |

| Sustainable Cashflow Growth Rate Beyond Year 10 |

The Sustainable Growth input provides the means to define the expected

future growth of this unit for the years after year 10 to value the

long-term cashflow potential of the unit. |

| Probability Score |

This input indicates the weighting for this scenario in the final

net value computation. This input can be 0 (ignore) to 100% (only

use this scenario). |

Figure 2. Scenario Input screen for

up to five scenarios to provide basis for computation; only three are

shown for brevity.

Go

on to Goodwill Impairment Analysis >

|